Debt to Sales Ratio

The debt-to-GDP ratio is the ratio between a countrys government debt and its gross domestic product GDP. Interpretation of Debt to Asset Ratio.

Debt To Equity Ratio Formula Calculator Examples With Excel Template

In general a lower ratio is better.

. Debt to Equity Ratio - What is it. Therefore the debt to asset ratio is calculated as follows. This ratio measures how much debt a business has compared to its equity.

The ratio reveals the relative proportions of debt and equity financing that a business employs. DebtEquity DE Ratio calculated by dividing a companys total liabilities by its stockholders equity is a debt ratio used to measure a companys financial leverage. Lets be honest - sometimes the best debt to assets ratio calculator is the one that is easy to use and doesnt require us to even know what the debt to assets ratio formula is in the first place.

This page provides the latest reported value for - Turkey Government. The debtequity ratio can be defined as a measure of a companys financial leverage calculated by dividing its long-term debt by stockholders equity. How to Calculate Debt to Assets Ratio.

A ratio of 01 indicates that a business has virtually no debt relative to equity and a ratio of 10 means a companys debt and equity are equal. The debt-to-equity ratio is one of the most commonly used leverage ratios. In this case the ratio is not the most accurate or reliable indicator of what the companys financial future looks like.

This shows the company has more debt funding in its capital structure. Using the World Economics GDP Database it is possible to. The debt ratio is a financial ratio that measures the extent of a companys leverage.

The debt ratio can be used as a measure of financial leverage. Sales Revenue QQ Last Year 007. A debt ratio is a.

If they had no debt their ratio is 0. As a quick example if someones monthly income is 1000 and they spend 480 on debt each month their DTI ratio is 48. In most cases a particularly sound one will fall.

Debt to Equity Ratio Formula Example. The debt-to-equity ratio is calculated by dividing total liabilities by shareholders equity or capital. Sales Revenue 5-Year Annual Average.

For instance with the debt-to-equity ratio arguably the most prominent financial leverage equation you want your ratio to be below 10. In Year 1 for instance the DE ratio comes out to 07x. By calculating a DSCR a lender will be able to determine whether the net income generated by a property or business will comfortably cover loan repayments including.

It is a measurement for the ability of a company to pay its debts. Turkey recorded a Government Debt equivalent to 42 percent of the countrys Gross Domestic Product in 2021. You may also look at the following articles to.

And then from Year 1 to Year 5 the DE ratio increases each year until reaching 10x in the final projection. Adani Green Energy Ltd one of the seven listed units of Gautam Adanis ports-to-renewables empire has seen its debt-to-equity ratio balloon to the second-highest in Asia raising alarm over whether the billionaires aggressive expansion plans has over-leveraged his businesses. This makes it a good way to check the companys long-term solvency.

The Debt to Assets Ratio Calculator is very similar to the Debt to Equity Ratio Calculator. It is the ratio of total debt long-term liabilities and total assets the sum of current assets fixed assets and other assets such as goodwill. According to the report Nigerias federal government debt service payments in the first four months of 2022 totalled N19 trillion which was greater than.

YTDYTD Last Year 2395. Here we discuss the definition and importance of debt coverage ratio along with the example. The debt to asset ratio is commonly used by analysts investors and creditors to determine the overall risk of a company.

If the company have a lower debt ratio then the company is called a Conservative company. Debt ratio Total Liabilities Total Assets. Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or annual basis.

Government Debt to GDP in Turkey averaged 4230 percent of GDP from 2000 until 2021 reaching an all time high of 7550 percent of GDP in 2001 and a record low of 2740 percent of GDP in 2015. If a company have a Debt Ratio greater than 050 then the company is called a Leveraged Company. Companies with a higher ratio are.

A ratio of DSCR over 1 is considered as good and more than 1 is considered desirable. The debt ratio is defined as the ratio of total debt to total assets expressed as a decimal or. But if you want to.

It indicates what proportion of a companys financing consists of debts. Current and historical debt to equity ratio values for Tesla TSLA over the last 10 years. For example a company.

The debt to equity ratio measures the riskiness of a companys financial structure by comparing its total debt to its total equity. The DCR of less than 1 signifies a negative cash flow. It is closely monitored by lenders and creditors since it can provide early warning that an organization is so overwhelmed by debt that it is unable to.

Debt ratio Total Debts Total Assets. This is a guide to Debt Coverage Ratio. Therefore the figure indicates that 22 of the companys assets are funded via debt.

Debt Ratio is a financial ratio that indicates the percentage of a companys assets that are provided via debt. Tesla debtequity for the three months ending June 30 2022 was 008. The investment may produce higher sales in the next fiscal year but the net debt-to-EBITDA ratio for the current fiscal year will be higher due to the increased debt.

Consider the financial information obtained from BotPlant Corporations. World Economics has upgraded each countrys GDP presenting it in Purchasing Power Parity terms with added estimates for the size of the informal economy and adjustments for out-of-date GDP base year data. The Gujarat-based companys debt-to-equity ratio of 2021 is only behind.

Debt to Equity Ratio DE 120m 175m 07x. For commercial lenders the debt service coverage ratio or DSCR is the single-most significant element to take into consideration when analyzing the level of risk attached to an investment property or business. The debt to equity ratio DE is calculated by dividing the total debt balance by the total equity balance as shown below.

A Debt Ratio Analysis is defined as an expression of the relationship between a companys total debt and its assets. The staggeringly high 1189 percent debt servicerevenue ratio in January-April is the worlds worst and underlines unsustainable fiscal policy analysts at the EIU said in a global note to investors on Wednesday.

:max_bytes(150000):strip_icc()/debtequityratio.asp_FINAL-0ac0c0d22215418a992fa7facd2354e6.png)

Debt To Equity D E Ratio Formula And How To Interpret It

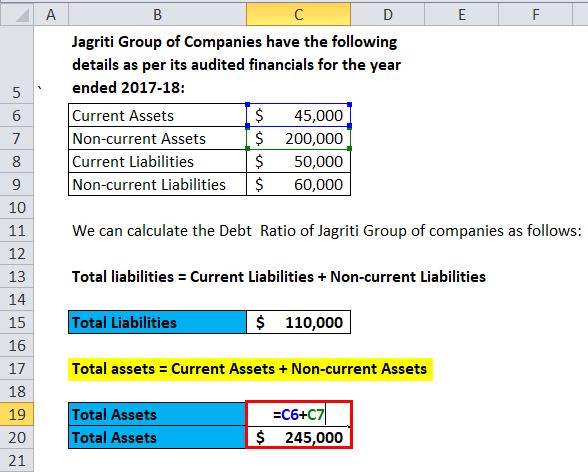

Debt To Asset Ratio Formula Meaning Example And Interpretation

Debt Ratio Formula Calculator With Excel Template

Debt Ratio Formula Calculator With Excel Template

Debt Ratio Formula And Calculator Excel Template

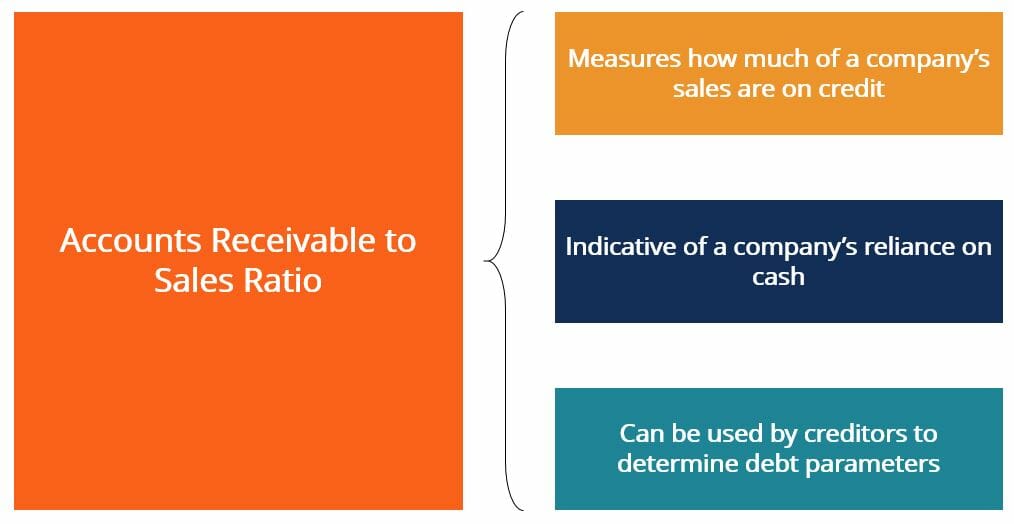

Accounts Receivable To Sales Ratio How To Calculate The Ratio

0 Response to "Debt to Sales Ratio"

Post a Comment